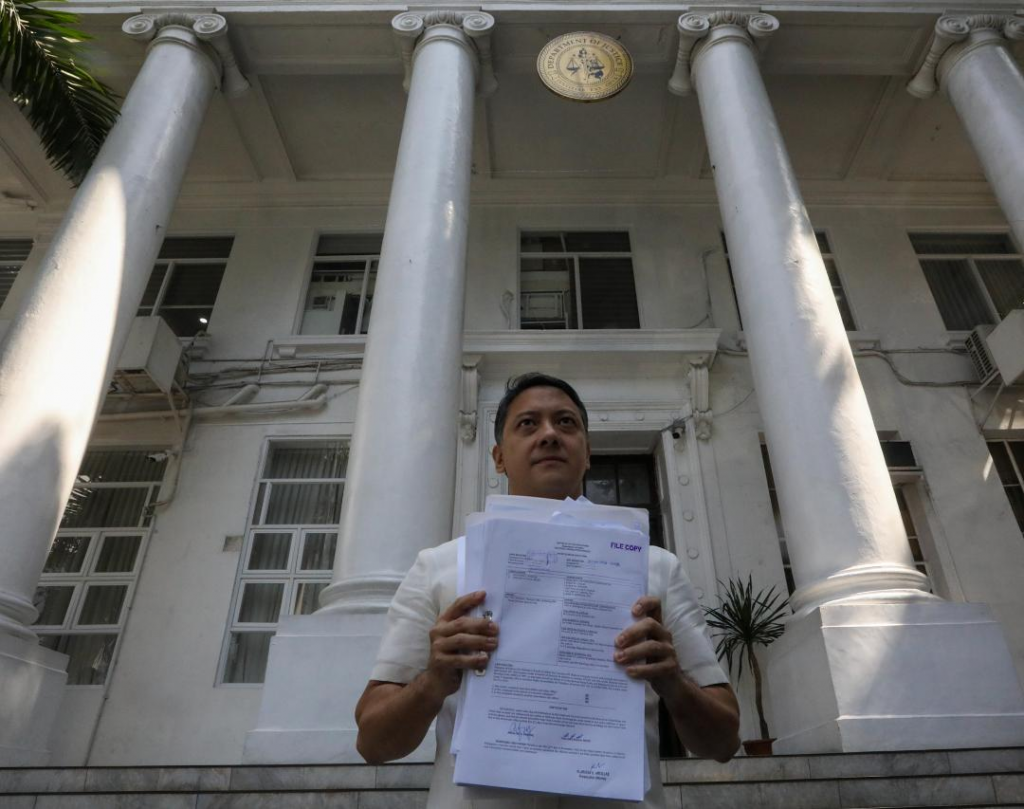

On Wednesday, November 22, 2023, Commissioner Romeo D. Lumagui Jr. of the Bureau of Internal Revenue (BIR), featured image, shows to the working media documents as he spearheaded the submission of 115 criminal cases to the Department of Justice on Wednesday (22 Nov 2023), amounting to a combined tax liability of 1.8 billion. These cases targeted individuals engaged in the illicit trade of “Ghost Receipts (GRs),” implicating both buyers and sellers.

The Run After Fake Transactions Task Force, under the BIR, has taken legal action against a total of 69 respondents accused of criminal involvement in the utilization and distribution of GRs. These respondents face charges for violating the National Internal Revenue Code (NIRC), specifically on tax evasion as outlined in Section 254.

The 115 criminal cases filed by the BIR primarily target corporations, corporate officers, and accountants. Commissioner Lumagui has identified these entities as alleged buyers and sellers of ghost receipts. This comprehensive legal effort aims to address the grave issue of fraudulent transactions and uphold the integrity of the tax system.

(Benjamin Cuaresma/ai/mnm)